The administrative side of your business can easily go overlooked by freelancers who are sometimes solely concerned with providing excellent services. However, working for yourself is not the only benefit of freelancing. Additionally, managing a variety of facets of your entrepreneurial life is involved. High-quality work and effective company organization are equally crucial. Hence, this guide will dive into the various business structures available to freelancers and how they can use them to grow themselves even more.

What is a business structure?

A business structure defines the legal and organizational framework that guides how a business operates, including managing, controlling, and taxing. It also determines the level of liability and ownership associated with the company.

Choosing the proper business structure is critical for entrepreneurs as it can have far-reaching legal, financial, and tax implications. Thus, it is advisable for entrepreneurs to carefully consider their options and seek expert guidance from qualified professionals before making any decisions regarding the business structure.

Why set up a defined business structure?

Here are a few reasons why a freelancer should set up a defined business structure:

-

The independent contractor could take advantage of tax advantages and deductions.

-

Before beginning a contract, some clients want proof that a freelancer runs a business.

-

The proprietors may receive extra legal and financial protection by registering as specific business organizations.

-

Some banks need a firm to be registered before applying for a business loan.

-

A freelancer may desire to seek funding from investors or find a co-owner.

-

The ability to cooperate with other businesses may be facilitated by having a registered company.

-

Any freelancing business that plans to function under a name other than the freelancer's own must file for business registration.

Types of business structures for freelancers

Sole proprietor

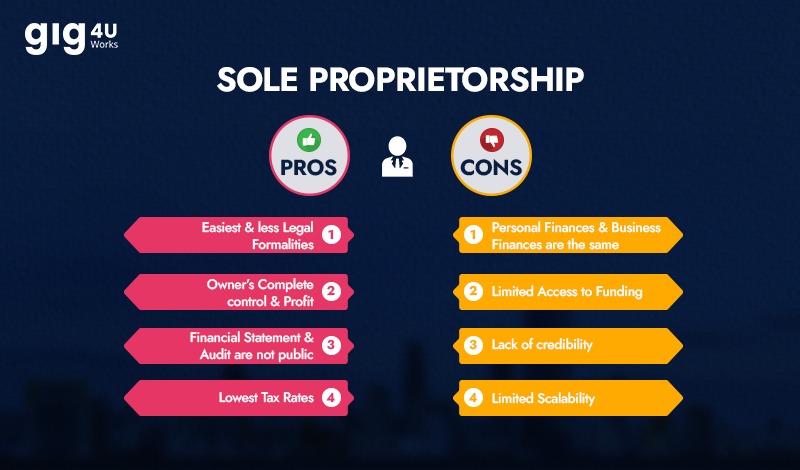

This is the preferred form for most independent contractors since it requires little paperwork and is inexpensive. With a sole proprietorship, you may run your firm as one person. A sole proprietorship has one of the lowest tax rates accessible to independent contractors, which is a significant benefit. Be careful, nevertheless, that this structure provides no liability protection. You will be responsible if your company has losses, or a client sues you.

The advantages of being a sole proprietor include the following:

-

Simple setup: A sole proprietorship is the easiest legal arrangement to create. This can be the greatest organizational structure if you and you alone control your company. Since you do not have partners or executive boards, there is relatively little paperwork.

-

Simple exit: A sole proprietorship is simple to start and dissolve. You can close your company as a sole proprietor at any moment without filing any official papers. For instance, if you open a daycare centre and decide to shut it down, do not run the facility or promote your offerings.

CONS: Although a sole proprietorship is an advantage for newbie entrepreneurs, there are several cons associated too.

-

Unlimited liability: The owner is personally responsible for all the debts incurred in the business. In case of financial losses, the owner's personal assets could be taken away to repay debts.

-

Limited access to funding: A sole proprietorship will find it difficult to access funding as banks and investors rarely provide loans or invest in a sole proprietorship. This could limit growth potential.

-

Difficulty in attracting clients: Sole proprietors usually find it hard to attract high-value clients and usually prefer working with established businesses. This could limit earning potential.

-

Lack of credibility: A sole proprietorship may not have the same level of credibility as a registered company. This could make it difficult to establish trust with clients and vendors.

-

Limited scalability: A sole proprietorship may not be scalable as it is dependent on the individual efforts of the business owner. This could limit the potential for growth and expansion of the business.

-

Limited ability to hire employees: A sole proprietorship may not have the ability to hire employees, which could limit the capacity of the business to take on larger projects or serve more clients.

Limited Liability Company (single or multi-member)

Depending on where you establish your firm, this structure does not cost much to set up and offers several advantages. If it serves your company objectives, you can run an LLC as an individual or with the inclusion of additional partners.

The liability protection that LLCs may offer is one of the primary reasons that small business owners select them. Those that use this framework often make it tough for creditors to pursue them. Please keep in mind that you might need to obtain a Tax Identification Number (TIN) before applying and that the renewal fees and other expenses might make it rather expensive.

The following are some benefits of freelancing through an LLC:

-

Professionalism: A decent website and effective self-promotion will help you increase your profile and draw in more customers if you operate as an LLC.

-

Room to grow: You can recruit staff if you create an LLC. This way, you will be able to grow your company bigger.

CONS: LLCs manifest in different forms in India as private ltd. company and one-person company, and there are cons too:

-

Compliance requirements: LLCs are subject to more compliance requirements than sole proprietorships, including the need for filing annual reports, maintaining records, and holding regular meetings. These requirements add to the cost of managing the business.

-

More expensive to set up: Setting up an LLC requires more paperwork and legal fees and hence pose a barrier for freelancers with limited resources.

-

More difficult to dissolve: Dissolving an LLC can be more complicated than a sole proprietorship. Expect more fees and complications when there are multiple owners.

-

Limited control: These companies need the approval of other shareholders or directors, thus limiting control.

-

Limited tax benefits: These structures may not be eligible for certain tax benefits, thus leading to higher tax liabilities for the owner.

Partnership

A partnership is a business that has two or more owners. There are two kinds: general partnerships, in which all partners share equally in the profits, and limited partnerships, in which only one partner oversees daily business operations while the other partner(s) contribute(s) to and shares in the profits.

Partnerships can be structured in different ways depending on your financial and legal needs. In some cases, a partnership might function as a sole proprietorship, with no distinction between the partners and the business. Alternatively, you could consider a limited liability partnership (LLP) to provide extra protection for your assets.

The cost of setting up a partnership can vary depending on a number of factors. In particular, if you are considering an LLP, it is a good idea to consult with an attorney to review your partnership agreement.

The benefits of being in a partnership include the following:

-

Easy to form: There isn't as much paperwork to submit for a company partnership as there is for a single proprietorship.

-

Possibility of growth: With more than one owner, you have a better chance of getting financing. If you have a subpar credit score, banks will take into account two credit histories rather than just one.

CONS: Although there are advantages, here are some cons of having a partnership firm; the disadvantages are similar to that of an LLC firm. One of the major drawbacks of a partnership firm is that as a multi-owner firm, the liabilities, if not fulfilled by a single partner, is going to be shared with other partners. They also require consensus among different partners before finalizing a decision, involving more money and

Corporation

While there are many types of corporations, 'S corporation' is particularly for freelancers and small businesses. These companies offer the same limited liability protection as traditional Private Limited Companies while providing greater flexibility and tax benefits.

In India, S Private Limited Companies are considered pass-through entities for tax purposes, meaning that the company's income, deductions, and credits are passed through to the shareholders and reported on their individual tax returns. This helps to avoid double taxation, which is a concern for many traditional corporations in India.

To qualify as an S Private Limited Company, a company must meet certain requirements and file the appropriate paperwork with the Ministry of Corporate Affairs. These requirements include having no more than 50 shareholders and meeting certain financial and operational criteria. S Private Limited Companies are a great option for those looking to start a small business in India, as they provide the same level of protection and prestige as traditional Private Limited Companies, with added flexibility and tax benefits.

The benefits of an S corporation include the following:

-

Pass-through taxation: As a pass-through entity, the company's income, deductions, and credits pass through to the shareholders and are reported on their individual tax returns. This helps to avoid double taxation, which is a concern for many traditional corporations in India.

-

Limited liability protection: S Private Limited Companies offer the same limited liability protection as traditional Private Limited Companies. Shareholders are not personally liable for the company's debts or lawsuits, which can help protect their personal assets.

-

Fewer shareholders required: S Private Limited Companies can have up to 50 shareholders, compared to traditional Private Limited Companies, which require a minimum of two shareholders. This can be an advantage for small business owners and entrepreneurs who want to keep ownership and control of their company limited to a select group of individuals.

Cons: A corporation is beneficial for several entrepreneurs but there are some cons associated with it. Many of these cons are similar to those of LLCs, but they are also difficult to access funding. They suffer from more scrutiny from investors and lenders, making it difficult to secure funding as freelancers starting out.

How do you choose the right Legal Structure for your Business?

Choosing the right legal structure for your business is essential in India as it could affect the company's liability, taxes, and also capital-raising capacity. Here's what you should consider when choosing the right legal structure for your business:

-

Liability: Consider the liability that you want to accrue on your business, whether your personal assets and net worth should be separate or connected to the company assets. Do you want to avoid potential lawsuits? Then form an LLC or a corporation. If risks are okay with you, consider a sole proprietorship or even a role-based partnership.

-

Taxes: Different legal structures are taxed differently. A sole proprietorship or a partnership is touted to be a pass-through entity where the owner's personal tax return will bear losses and gains. A corporation is taxed as a separate entity and could be taxed doubly.

-

Ownership: If you are the sole owner, a sole proprietorship or an LLC is a good option. With multiple owners, a company could be a partnership, LLC or corporation.

-

Funding: If you plan to raise capital, a corporation is the perfect choice, as it allows stock issuance. An LLC or a partnership could limit the ability to raise capital without the ability to issue stocks.

-

Complexity: A sole proprietorship or a partnership are simple business models but do offer limited liability protection. A corporation, though, would require a lot of formalities and could also provide the highest limited liability protection.

Conclusion

Which entity to employ for a freelancing business depends on a variety of circumstances.

The explanation given above highlights some of the factors that make it important for independent contractors to take their time when selecting a model. Consult with a business attorney and a certified tax specialist to discuss which sort of entity is best for you and your company if you are unclear about which business structure will work for you.